oklahoma state auto sales tax

800 am to 430 pm. How much is the car sales tax rate in Oklahoma.

Oklahoma Vehicle Registration And Title Information Vincheck Info

In Oklahoma the excise tax is.

. With local taxes the total sales tax rate is between 4500 and 11500. Average Sales Tax With Local. 421 NW 13th Suite 330 Oklahoma City OK 73103 Local.

609 rows Lowest sales tax 485 Highest sales tax 115 Oklahoma Sales Tax. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is 877. For vehicles that are being rented or leased see see taxation of.

Online Registration Reporting Systems. Darcy Jech R-Kingfisher would. Businesses can check the Oklahoma Tax Commissions page for new and updated lodging taxes.

Commissionoumvdmhcokgov Office Hours Additional Information 800 AM - 400. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle. This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases.

Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments. 405-607-8909 emailomvcokgov Office Hours. Oklahoma also has a vehicle excise tax as follows.

An example of an item that exempt from Oklahoma is. We would like to show you a description here but the site wont allow us. Counties and cities can charge an additional local sales tax of up to 65 for a.

In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Imagine that your monthly lease payment is 500 and your. When a vehicle is purchased under current law a sales tax of 125 percent is levied on the full price of the car.

Oklahoma has a statewide sales tax rate of 45 which has been in place since 1933. Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 426 on. This is the largest of Oklahomas selective.

The sales tax rate for the Sooner City is. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125. Senate Bill 1619 authored by Sen.

Printable PDF Oklahoma Sales Tax Datasheet. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle. Oklahoma has recent rate changes Thu Jul 01 2021.

Oklahoma has state sales tax of 45 and allows local. Motor vehicle excise tax. There are special tax rates and conditions for used vehicles which we will cover later.

In addition to the 125 sales tax buyers. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. Oklahomas motor vehicle taxes are a combination of an excise sales tax on the purchase of a vehicle and an annual registration fee in lieu of ad valorem property taxes.

4334 NW Expressway Suite 183 Oklahoma City OK 73116 Phone. The state sales tax rate in Oklahoma is 4500. OK Sales Tax Calculator.

Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. OKLAHOMA CITY On Wednesday the Senate approved Senate Bill 1075 to reinstate the full sales tax exemption on motor vehicles and tractor trailers.

Lower Taxes On Car Purchases In Effect In Georgia Georgia Thecentersquare Com

In States With Property Tax On Cars Do I Also Have To Pay Sales Tax Mansion Global

Eighth Biennial Report Of The Oklahoma Tax Commission For The Period Beginning July 1 1946 And Ending June 30 1948 Archives Ok Gov Oklahoma Digital Prairie Documents Images And Information

What New Car Fees Should You Pay Edmunds

2018 Edition Max Platinum Ford Expedition For Sale In Oklahoma City Ok Cargurus

Oklahoma Title Transfer How To Sell A Car Quick At Fair Prices

8 Tips For Buying A Car Out Of State Carfax

Used Cars Suvs Trucks For Sale In Oklahoma Express Credit Auto

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Lawmakers Ok 1 25 Sales Tax On Cars

Oklahoma Supreme Court Rules Automobile Sales Tax Is Constitutional Kokh

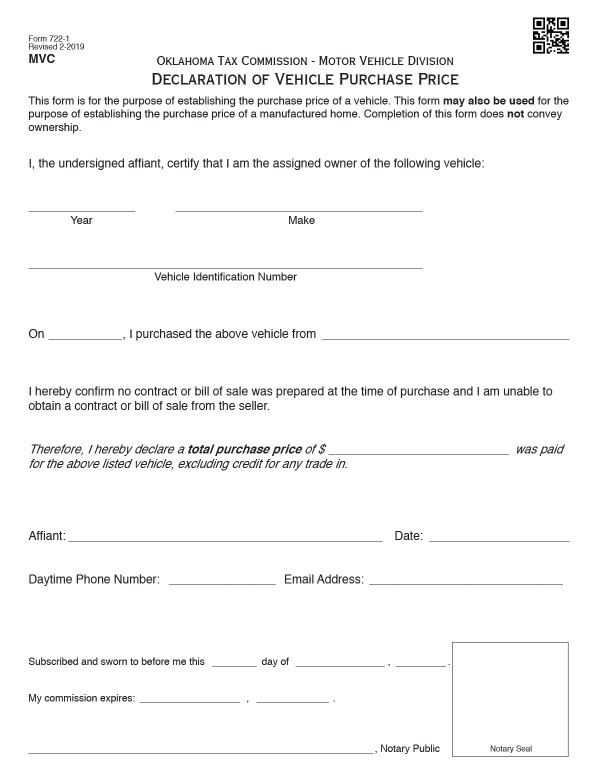

Bills Of Sale In Oklahoma The Templates Facts You Need

What S The Car Sales Tax In Each State Find The Best Car Price

Kia Vehicles Enterprise Car Sales

Oklahoma Drivers Must Carry Registration Starting July 1

Free Oklahoma Motor Vehicle Dmv Bill Of Sale Form Pdf

Used Cars In Missouri For Sale Enterprise Car Sales

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

Oklahoma House Passes Exemption On Motor Vehicle Sales Tax Kokh